Since television’s introduction in the 1920s, its role in popular culture has constantly evolved. By 1955, over half of American households owned a television set. In 1969, an unprecedentedly large audience of 650 million people worldwide gathered around their TV screens to watch the first-ever moon landing. In the 70s and 80s, children patiently waited all week to watch the Saturday morning cartoons.

Today, the motion picture scene has become plagued by an expensive mess of streaming platforms, far from the comfort of old weekend classics. Rising prices and an oversaturated market make it increasingly difficult to justify streaming’s domination of the entertainment industry, and streaming companies should reconsider their trajectory before losing the trust and loyalty of customers.

The large success of streaming services in the past decade has given them free rein to decide their pricing. In October 2010, roughly 90% of American households paid for cable television service. Now, less than half do. The promise of a larger-than-ever catalog of accessible entertainment at a lower price has led many Americans to “cut the cord” and switch to streaming. Unfortunately, it has become clear that keeping this promise was never the plan.

In 2007, Netflix introduced its revolutionary online streaming service, granting subscribers access to a catalog of movies and TV shows for only $8.99 a month. In comparison, the average price for Cablevision, now called Optimum, was $75 per month that same year.

By 2022, Netflix had increased its monthly fee for a standard subscription to $15.49. The platform also increased the price of its premium plan from $19.99 to $22.99 and introduced a plan with ads for $6.99.

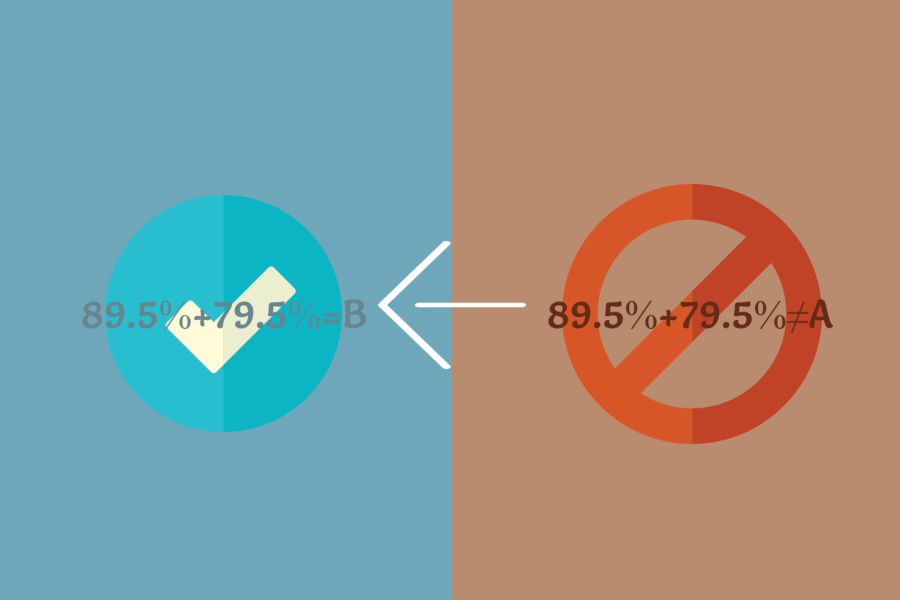

The introduction of advertisements into media streaming is particularly concerning, and Netflix isn’t the only company incorporating ads into its payment plans. Over the past few years, Disney+, Peacock, Paramount+, HBO Max and Prime Video have all introduced cheaper plans with ads while increasing the price of their standard plans. Other features are also slipping away behind price increases. Prime Video, the most recent platform to raise its prices, added a paywall to video and audio enhancing technologies — such as Dolby Vision and Atmos— behind a $2.99 per month price increase. Most of the original appeal for streaming services was in the ad-free watching experience. According to Forbes, 50% of streaming users pay extra to watch without ads. Consumers now have to decide whether to pay ever-increasing prices for the full streaming experience or forfeit features previously included in their plan.

Americans pay for an average of 2.9 streaming service subscriptions a month. However, 45% of subscribers have canceled at least one of their subscriptions in the past year. Additionally, almost half of Americans have indicated that their streaming subscription costs have risen over the past 12 months. These changes in the market are apparent to most consumers, including economics teacher Thomas Young.

“I’m not a business person, but I gather that the market has irrevocably changed,” Young said. “No longer do you have a single entity that’s going to package all your media consumption together; I think those days are fading away.”

The cable television industry continues to decline steeply, much to the advantage of streaming companies. Currently, cable companies are scrambling to save their dying platform as many of them edge closer to bankruptcy every day. In September, cable company DirecTV agreed to buy its rival Dish for $1 — saving the network from its $10 billion debt.

This year, Warner Bros. Discovery, Paramount and AMC wrote down over $15 billion of collective debt, claiming a reduction in their assets’ value. As cable loses popularity, cable ad revenue continues to decrease. In 2023, cable providers netted an estimated total of $22.3 billion, a 4.9% decrease from the previous year. These numbers will only worsen, as profits are predicted to fall under $20 billion by 2027. Although cable companies have lost ad revenue, freshly monetized streaming services are swimming in it. In fact, as cable companies continue to build debt, streaming services enjoy a 27% increase in revenue.

Since cable’s dip in popularity, streaming has come full circle to what made people gravitate away from cable in the first place. Unlike cable, however, streaming creates room for more unique inconveniences.

To profit in a competitive market, companies such as Netflix or Disney+ rely on a mixture of licensed intellectual property (IP) and original content to make up their streaming catalog. Licensing entertainment is an effective way to generate profit, but the licensing process of IPs often splits their associated television productions up across multiple platforms. For example, if someone wanted to watch the entirety of the anime series “Pokémon,” they would have to use eight different streaming services. Streaming platforms frequently play tug-of-war with popular IPs, forcing consumers to purchase another subscription to regain access to a series. On January 1, 2021, NBC stripped Netflix users of their ability to stream “The Office” in the US, despite it being Netflix’s top-viewed series in 2018. To continue watching the mockumentary, fans must purchase a Peacock subscription. Many other popular TV shows, such as the cartoon sitcom “Rick & Morty” or the hit mystery-horror drama “Twin Peaks” have also been handed off to different services. The short life spans of popular IPs on individual streaming services puts pressure on consumers to spend excessive money to enjoy once-centralized content.

For consumers, the future of television is undoubtedly grim. Prices will continue to rise, shows will continue to scatter across platforms, and as cable loses popularity, streaming services will gain total domination over the industry. Streaming companies must prioritize customer loyalty by abstaining from paywalls, reducing content fragmentation and offering consistent pricing. Without these changes, television risks becoming a luxury few can afford.