Swiping, tapping and inserting — in an age of hyperconsumerism, these actions are more familiar than ever to the American consumer. The use of credit cards, both digital and physical, is the new norm. People continue to use less cash, and it is currently used in only 16% of all legal transactions.

Despite the ease of using such digital payment methods, the decline in cash usage has unintended side effects.

The “cashless effect” is a phenomenon where customers tend to overspend when paying digitally rather than using paper money. This phenomenon disproportionately affects teenagers, the most likely age group to use digital wallets. The counters to minimize overspending from the cashless effect are simple: teenagers should carry cash and attempt to minimize their use of digital payment methods, and parents should encourage the same.

Although the risk of overspending applies to everyone, it impacts Generation Z disproportionately, with the Washington Post reporting that 80% of Generation Z use mobile wallets.

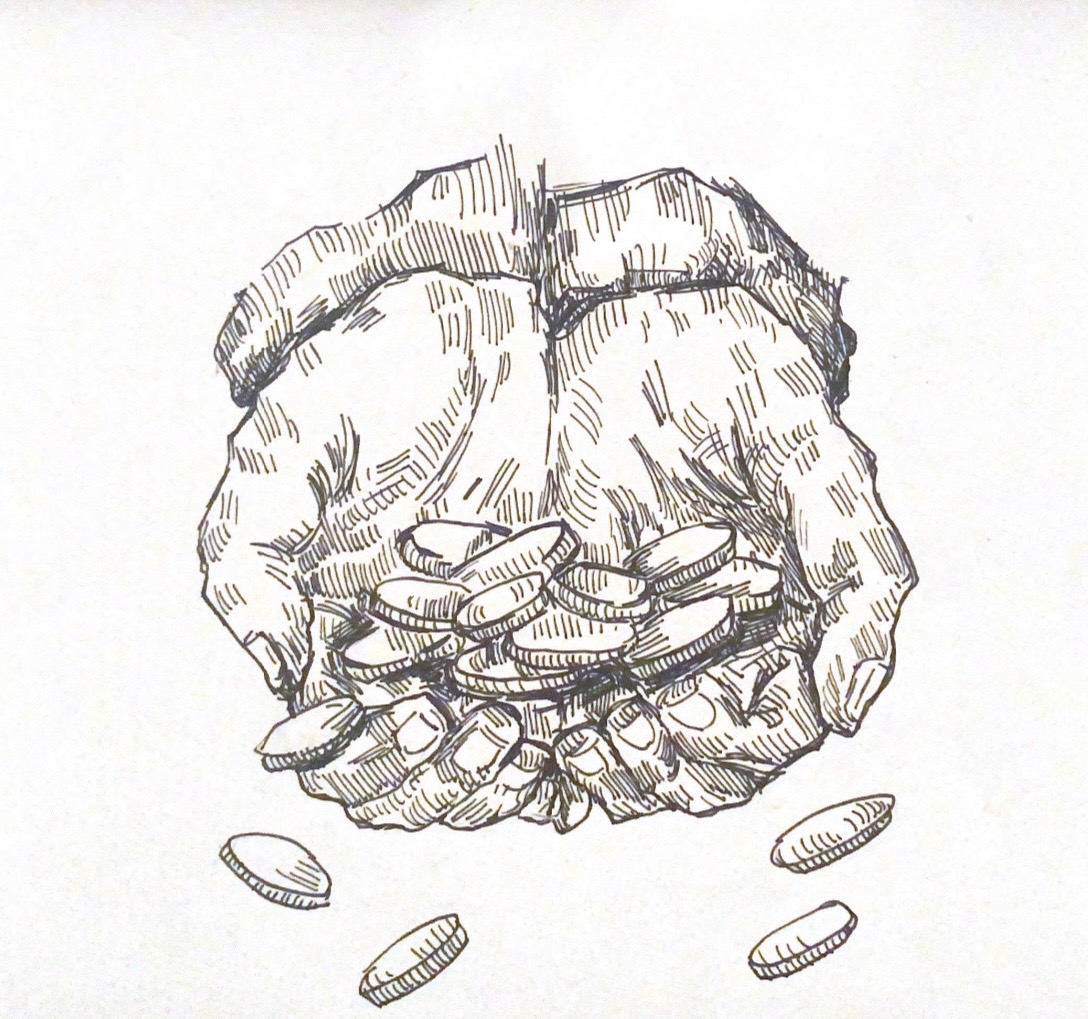

The psychological reasoning behind the cashless effect is surprisingly straightforward but powerful enough to endanger the financial health of an entire generation. Physical money is quantifiable, whereas spending digitally is abstract. Handing over cash is more purposeful than simply tapping or inserting a card into a reader. Since you can see and feel your money leave your hand, the negative feeling of spending is significantly amplified. When using a digital method, however, the customer doesn’t feel that negative sensation of losing physical money as prominently, potentially leading to frivolous and impulsive spending.

When people pay with cash, they are subject to “loss aversion,” a feeling of loss that is more severe psychologically and emotionally than the equivalent gain. For instance, due to loss aversion, the pain of losing $100 is often much greater than the joy of gaining the same amount. Cutting out loss aversion through digital payment can lead to even more overspending, and more risk.

In his personal finance class, Whitman teacher James Groff covers the cashless effect and how it impacts loss aversion.

“By being cashless, you almost get rid of this loss aversion,” Groff said.

Online shopping is the biggest perpetrator of the cashless effect, and experts expect

an increase in how many people shop online. Companies more than ever are reducing even the amount of clicks it takes to buy their products. The allure of buying anything with a few simple clicks without the feeling of losing anything continues to be risky when left unchecked. To combat this, parents must monitor their teenagers’ spending habits. Having an outside perspective on purchases could help prevent unnecessary clicks and save money. As they are with digital wallets, Generation Z comprises the largest group of frequent online shoppers compared to other age groups, so making plans to counteract online shopping and the cashless effect are especially crucial for them.

Cash does come with a cost, however. ATM fees can be significant, which underscores the need to plan ahead. The cashless effect isn’t going to disappear anytime soon. So, while paying with cards or phones is extremely convenient, customers should take the time to fully understand how the cashless effect can impact their spending habits — before the accounts hit zero.