MCPS: Make personal finance a graduation requirement

February 5, 2019

Many students will take math classes as challenging as Calculus by the end of high school, but almost all students forget one of the most practical applications of math: finance.

Financial responsibility is crucial for economic success in life, and it’s growing more and more complicated every day. Today, there are seemingly endless ways to save for retirement, invest and pay bills, yet students remain woefully uninformed about their future financial options and responsibilities.

To prepare students for their financial futures, MCPS should make the personal finance class a high school graduation requirement.

Personal finance teaches students to take out loans, invest in stocks or funds and pay taxes without putting themselves at risk of debt. Entering adulthood without financial knowledge is like driving a car without taking driver’s ed, personal finance teacher Demitra Marafatsos explains. It leaves students unprepared and in severe danger.

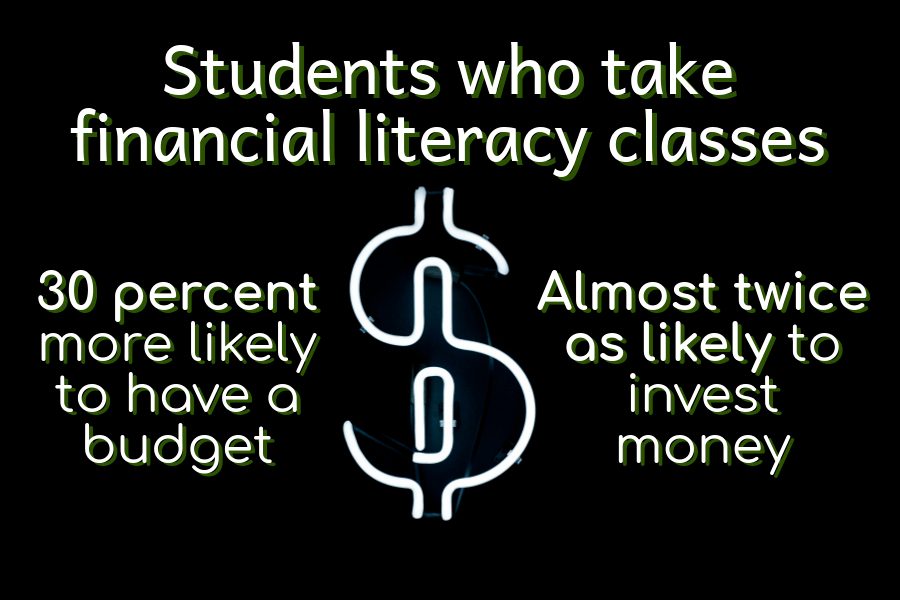

Students who take financial literacy classes are 30 percent more likely to have a budget and almost twice as likely to invest money, according to the Council for Economic Education.

Requiring students to take personal finance would also increase the likelihood that they’d have high credit scores in the future. A study funded by FINRA Investor Education Foundation found that states that implemented rigorous high school requirements in finance—such as Georgia, Idaho and Texas—saw young adults’ credit scores increase by 11, 16 and 32 points respectively. Higher credit scores translate to greater access to mortgages, loans and even employment opportunities.

And the costs to make finance a required course—implemented through hiring additional staff—are by no means unreasonable. Maryland’s Carroll County only paid $37,000 to add the required course to all eight of its high schools, according to a 2012 US News article. Since personal finance is only a semester course, it also wouldn’t be too taxing for students to fit it into their schedule. Students would have the option to pair it with health, knocking out two required courses in one year.

Opponents argue that a personal finance requirement is unnecessary because Maryland has already integrated some financial topics into the K-12 curriculum. However, these topics aren’t tested and there’s no form of oversight, so teachers only briefly mention them or fail to include them at all. In fact, only 50 percent of Maryland’s high school seniors recall receiving any personal finance instruction at all, according to a 2015 Maryland State Department of Education survey.

As managing money grows more and more complex, financial literacy is becoming extremely crucial in people’s daily lives. The county should recognize the importance of economic responsibility by providing students with the financial knowledge to have a secure and successful future.