MD: Don’t offer Amazon $3 billion in incentives

April 21, 2018

When Amazon announced its search for a location for a second North American headquarters—known as HQ2—over 50 areas jumped at the opportunity, including Maryland. By the time Amazon announced the final list of contenders, a full-on bidding war between the locales had sparked.

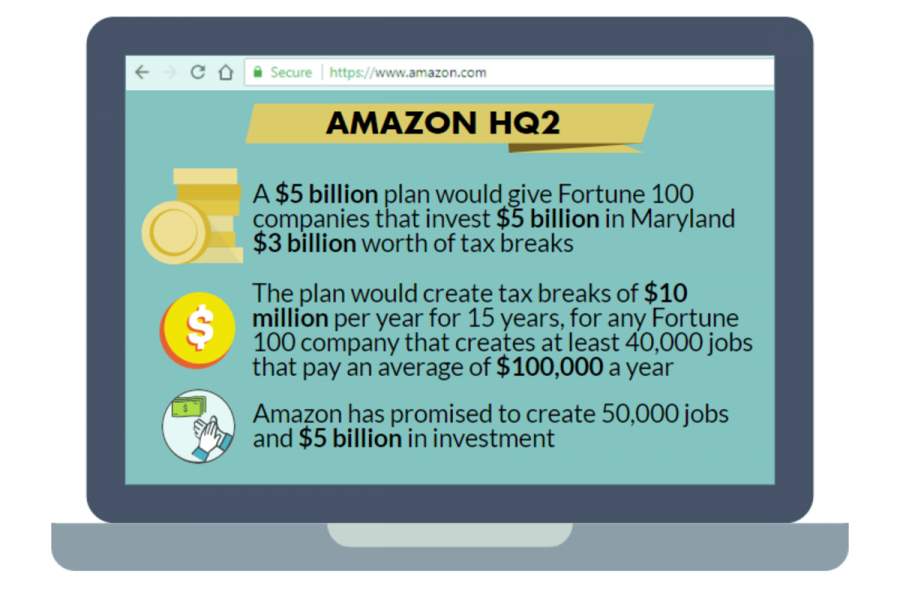

One way state and local governments have attempted to make their area appealing to Amazon is through tax incentives: communities attempt to “race to the bottom” by offering Amazon increasingly large tax cuts in exchange for the new headquarters. Maryland is no different: with Montgomery County on the final list of twenty possible locations, the Maryland House of Delegates approved a $6.5 billion tax incentive package for Amazon on Wednesday, including income, property and sales tax credits, with an additional $2 billion in government investment in local transportation.

Maryland—and other states in the running—shouldn’t offer Amazon billions of taxpayer dollars in tax incentives: it won’t make Amazon more likely to move here, it’ll cost our state billions and, if successful, it might not provide the benefits Amazon promises.

Tax incentives don’t tend to heavily affect companies’ decisions on where to locate. Instead, businesses choose locations based on other local factors like workforce capability, high quality of life and good infrastructure, Megan Randall of the Tax Policy Center said. A company’s overall net profit is more affected by having educated workers, good roads and opportunities for expansion than by tax rates that are lowered by one or two percent. If Amazon is planning to move to Maryland, the possible tax breaks won’t be the cause—they’re a poor substitute for good infrastructure (which Montgomery County already has).

Furthermore, despite the fact that tax breaks are generally not a large factor in companies’ decision-making, giant companies can pretend that they are—and use incentives as a bargaining chip to force local governments’ hands. That’s been Amazon’s strategy all along: a 2016 report by nonprofit Good Jobs First found that historically, Amazon has negotiated for large tax breaks in exchange for locating fulfillment centers in certain locations despite having already privately finalized the location. Giving Amazon giant tax breaks is effectively a handout: it’s pointless and wasteful. Even worse, many smaller businesses can’t afford to bargain with local governments over taxes in the same way and are thus put at a comparative economic disadvantage.

States—and Maryland specifically—could better use the money lost by granting tax to invest in the community services that draw smaller businesses in larger volumes. Infrastructure like good schools, good roads and good public transportation are what draw companies to Maryland and keep them here: the $2 billion transportation investment included in the plan might be just as economically positive for Maryland in the long term as the stimulus that Amazon could bring.

Supporters of the bill contend that Amazon could add $17 billion to the Maryland economy—and the company itself predicts that HQ2 will create add 50,000 jobs to its new home city. Additionally, Maryland’s package supposedly has a failsafe: it would only award Amazon the promised tax breaks when it creates at least 40,000 jobs that pay an average of $100,000 a year. In the event that this happens, yes, the new jobs possibly added will bring new economic opportunities to the state, but they’ll also increase strain on local infrastructure like schools, roads, and public utilities—strain that might not be adequately eased by the increase in income tax revenue. In fact, despite the investment that Amazon might bring, legislative analysts for the Maryland House of Delegates still predict that the package would deprive state and local governments of $6.5 billion in lost revenue and increased costs over the next 35 years.

Overall, any incentive that requires a tradeoff between public funding and private investment will face controversy. The incentives Maryland is offering Amazon, however, should face far more scrutiny than is currently apparent.