Tampons are necessities: tax them that way

January 31, 2017

Tampons or food. Every month, some women in Ohio’s 35th district are forced to make the choice between feeding their families or taking care of themselves because of unfair taxes applied to feminine products.

“There is definitely a high price for being a woman in the state of Ohio,” Representative Greta Johnson (Ohio D-35) said. “Tampons are medical necessities, not luxury items.”

Ohio women aren’t alone in facing high personal hygiene costs: 40 states nationwide have a feminine tax, with the exception of Maryland, Pennsylvania, Minnesota, New Jersey and Massachusetts who have banned the tampon tax, and Oregon, Alaska, New Hampshire, Delaware and Montana who don’t have any state sales tax, according to a January 2016 Washington Post article.

Most states tax all “tangible personal property” but make exemptions for select “necessities,” or non-luxury items. “Necessities” usually include groceries, food stamp purchases, medical purchases, clothes (in some states) and agriculture supplies. The “tampon tax” refers to the sales tax applied to tampons, sanitary napkins and panty liners that are deemed “luxury” items, rather than being labeled as the necessities that they are. Depending on the state, the tax can be between 2.9 and 7.5 percent, according to the Tax Foundation.

All states should exempt feminine products from the tax to eliminate this extra cost burden that is exclusively placed on women.

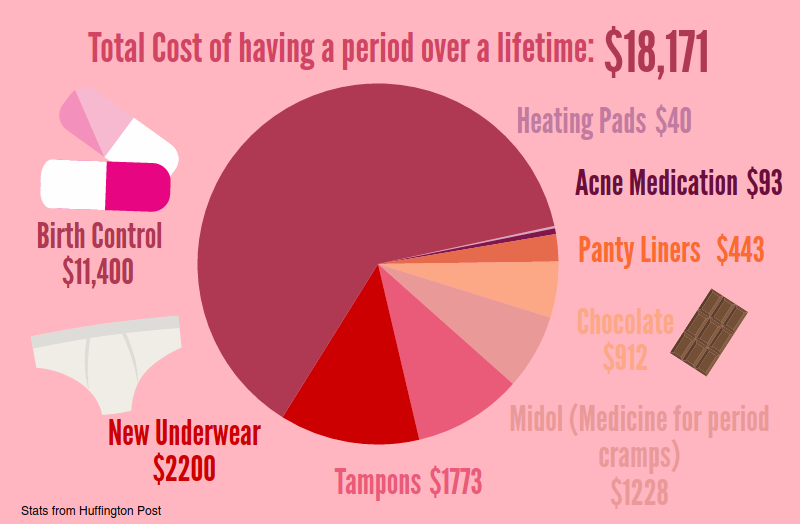

The high costs of having to buy products every month quickly add up for women. The average woman spends $120 per year on pads and tampons, Groundswell Organization found, meanwhile, men are spared this cost.

“I see this as an equality issue, a civil rights issue and a fairness issue,” Wisconsin Representative Melissa Sargent (D-48) said.

If men aren’t burdened by the tax, then women shouldn’t be either.

In fact, products used by men are often exempt from the luxury tax that tampons are still subject to. In some states with tampon taxes, viagra and condoms are exempt from the tax because they are considered medical necessities, NPR reports in 2016.

When asked by reporters why many states have such an unfair and unequal policy, President Obama explained it best: “I suspect it’s because men were making the laws when those taxes were passed.”

Products for men that aren’t necessities are free from excessive taxation, while women are still forced to pay for products they literally cannot live without.

The taxes have especially burdened impoverished women, forcing them to choose whether to take care of their hygiene or buy food.

Four homeless women told their stories in Cosmopolitan in 2015, explaining that they’ve had to spend their food money on tampons, use their shirts as pads and find other ways to deal with their period because they can’t afford to buy products.

Eliminating such a targeted tax would allow these women to spend money on other important items, rather than worrying about their periods.

“By putting that money back in the hands of women, we are creating greater access to a very important health product—especially in low-income and homeless populations,” California Assemblywoman Ling Ling Chang said.

The majority of states are operating under a tax policy that disadvantages women and pushes poor women deeper into poverty. Women don’t have a choice about buying tampons—it’s unavoidable. States need to finally treat women equally and see tampons as the necessity they are.